How To Upload Bank Statement .qbo File Online Quickbooks

On the surface, importing bank transactions into QuickBooks Online seems piece of cake. For many users, it's every bit unproblematic as signing into your bank or credit card accounts through QuickBooks Online. But sometimes limitations and challenges can arise when importing transactions into QuickBooks Online.

To assistance you lot become the most from your business organisation accounting software, this article will familiarize you with the QuickBooks Online Banking characteristic, and provide in-depth instructions for using it to import your bank transactions.

Quickbooks Online

QuickBooks Online Cyberbanking (bank feed) feature

Bank transactions are imported into QuickBooks Online using the Banking (or banking concern feed) feature. This characteristic serves two singled-out purposes: reconciliation and facilitating data entry.

Reconciliation

The Banking feature provides a way to reconcile your business's bookkeeping to your banking company'due south records, almost in real-time. At that place is oftentimes a 24-hr lag in updates, depending on how your depository financial institution communicates with QuickBooks Online. Even with this lag, using the Banking characteristic to reconcile daily — or every few days — is still quicker than the traditional reconciliation method where you wait for your bank or credit menu statement to get in in the postal service. This quicker reconciliation gives you an opportunity to detect certain bug — similar an unexpected overdraft or potential fraud — much sooner than waiting until the end of the month when your bank or credit card statements arrive.

Keep in mind, fifty-fifty though the Banking characteristic gives you the ability to compare your bookkeeping with your bank's records daily, this quick reconciliation does non replace the need to do the traditional monthly reconciliation of your accounts against the statements prepared past your financial institutions. Even if your banking company balance and QuickBooks amounts match when you are done accepting or matching transactions, information technology's notwithstanding important to conduct a complete reconciliation of your accounts each month.

Data entry

Many QuickBooks Online users rely solely on the Cyberbanking feature to do their accounting. This can result in pregnant errors in your books.

Using the Banking feature to import bank transactions into QuickBooks Online is a way to expedite your accounting by eliminating some data entry, especially for recurring automatic transactions. However, go on in mind this is a reconciliation feature meant to compare your books with your financial institution'due south records.

Certain transactions — similar checks you've written, payments you've received from customers and asset purchases — should always exist entered into your accounting records when they occur and so "matched" to the transaction in the bank feed when the transaction clears the banking concern. This volition prevent mistakes in your bookkeeping and — specially in the case of checks that haven't cleared the bank yet — will help y'all keep tabs on your true available cash balance.

This doesn't hateful you have to become back to manual data entry for every transaction, though. There are a plethora of tools — similar Receipt Bank and Bill.com — that connect to and push these "lagging" transactions into QuickBooks Online for you.

The takeaway from this section: Utilise the Banking characteristic to assistance you with some data entry, simply resist the temptation to rely solely on imported banking concern transactions to practice your bookkeeping.

How to import bank transactions into QuickBooks Online

At present allow'due south go down to the concern of importing your bank transactions into QuickBooks Online. There are 2 ways to practice this:

-

Connect direct to your fiscal institution

-

Import from Excel

Following is a footstep-by-step guide for each method.

Connect to your financial institution

Connecting your banking concern and credit bill of fare accounts in QuickBooks Online is the quickest and most reliable way to import transactions into the Banking feature. It's also secure; your bank login information is encrypted and protected, meaning no i can admission your bank accounts, fifty-fifty if they take access to your QuickBooks Online subscription.

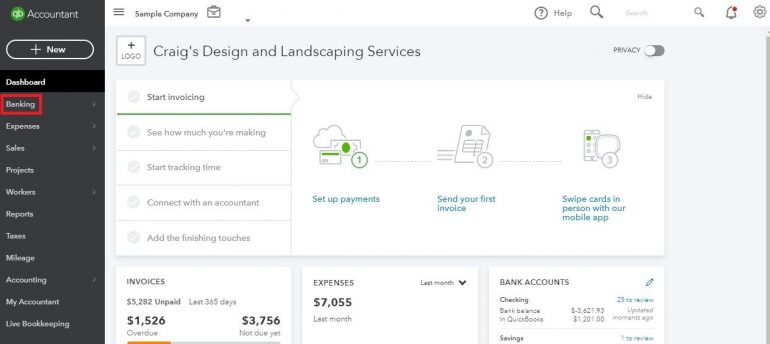

1. From the Dashboard, click on Banking.

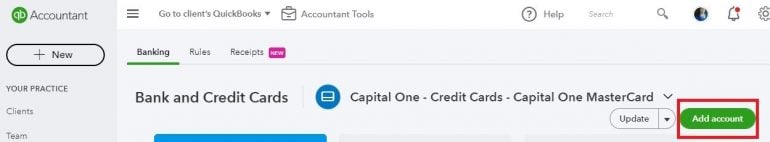

2. Click the Add together Account push.

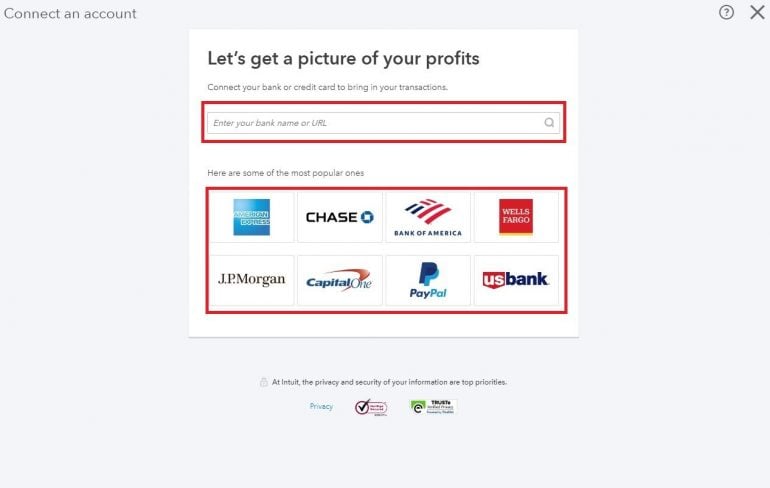

3. Enter your financial institution'due south name or the URL where you sign into your account. When yous commencement typing the name of your financial institution, a list of options will appear in a drib-downwards box and you tin select the correct option from it.

Alternatively, you can click on the logo of one of the popular banks shown on this screen.

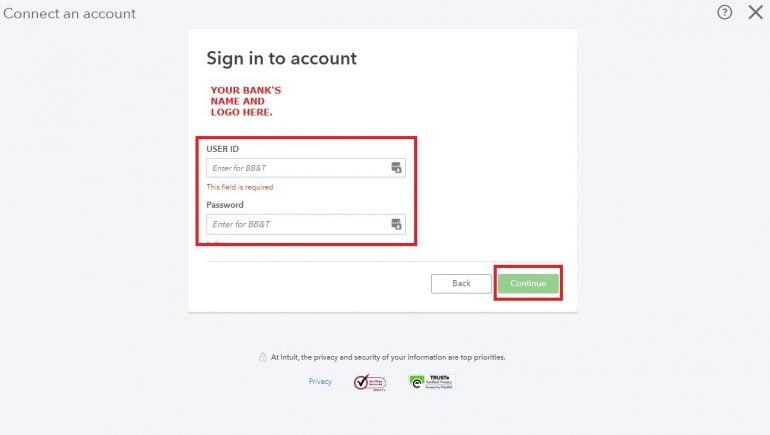

4. Enter the required data and click Continue.

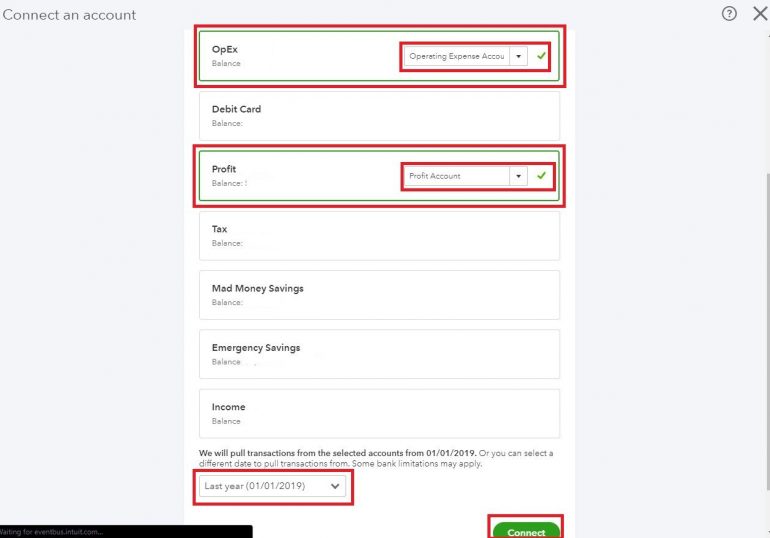

v. From here, you will get a listing of accounts to connect. The current residual in each account will be shown (it's been redacted this on the screenshot for privacy). Select the accounts you want to apply to import transactions into QuickBooks Online. If you lot have your personal accounts and your business accounts at the same financial institution, make sure to only connect your business organisation accounts. This will go along your business and personal finances separate, which is crucial to good bookkeeping.

Equally you select each account, yous will exist prompted to enter the account type from a drop-down menu. Map each account you are importing transactions from to the respective bank business relationship you've currently set up in your chart of accounts. Y'all can also add the bank account on the wing past clicking on "add new" at the acme of the drib-downward listing.

Finally, select the beginning date you want to utilise to pull transactions. Note that your banking company might restrict how far back you lot can import transactions.

One time y'all accept selected the account(s) yous want to connect, click Connect.

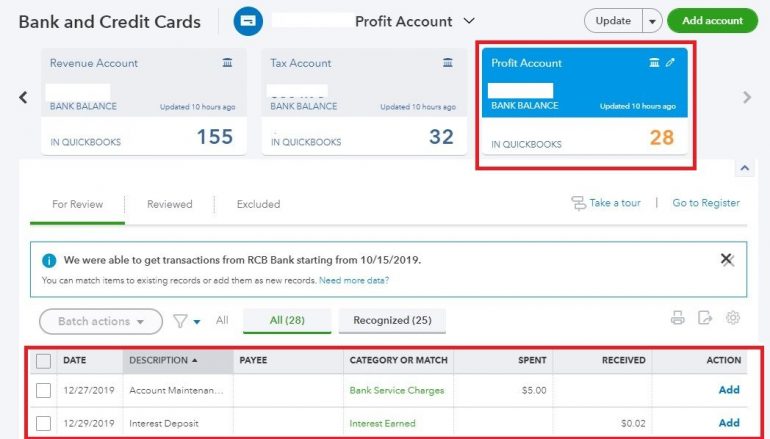

half dozen. The bank transaction import will begin. This can be virtually instantaneous, or it can take several minutes, depending on how many transactions at that place are to import. Once completed, you will exist returned to the Cyberbanking screen, where yous can commencement matching or adding the transactions that have been imported.

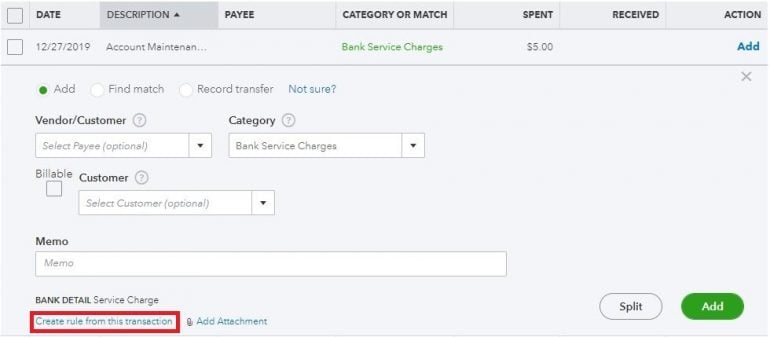

vii. As you're adding or matching your transactions, yous can create rules in order to expedite this process moving forward. Rules are especially helpful for recurring automatic transactions you might not have receipts for, like bank fees and subscriptions. Click into a transaction — in this case, we chose the "12/27/19 Account Maintenance" transaction — and and so click "Create rule from this transaction."

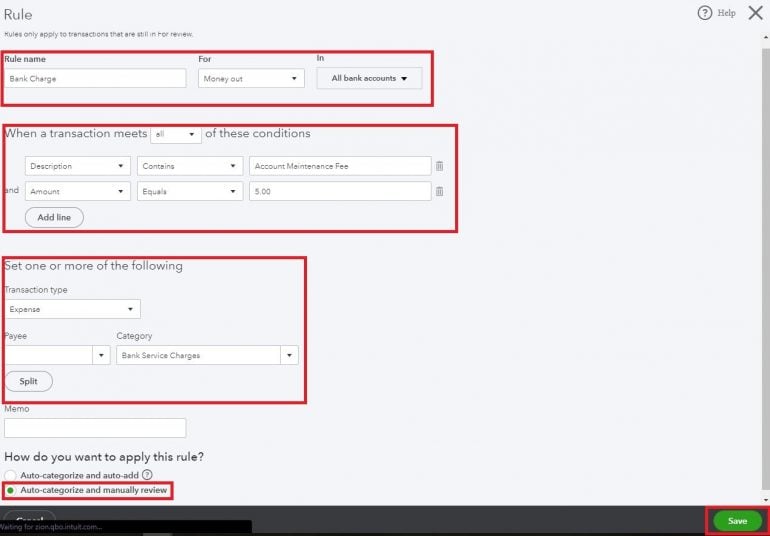

Now you tin set the conditions yous desire to use to utilise the rule. We recommend using the "Car-categorize and manually review" option and then you nevertheless see the transaction in your depository financial institution feed, merely it'south automatically categorized based on the rule. This helps prevent misclassification errors and duplicate entries. When you lot are done setting the atmospheric condition, click Save to apply the rule and return to the Banking screen.

viii. After the initial connection to your financial institution, your banking concern transactions will unremarkably be imported automatically every day. Occasionally, though, y'all might have to update the connexion.

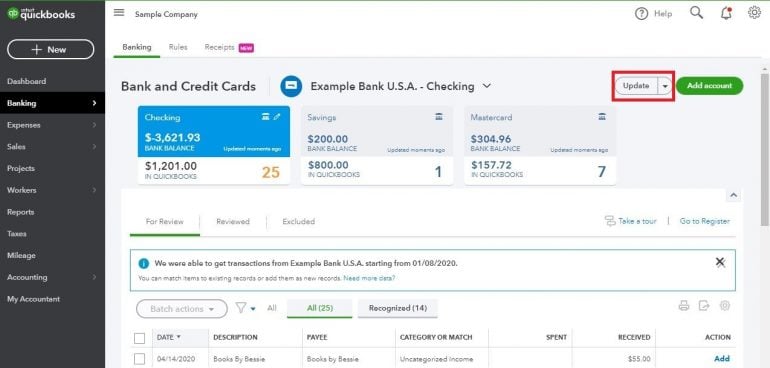

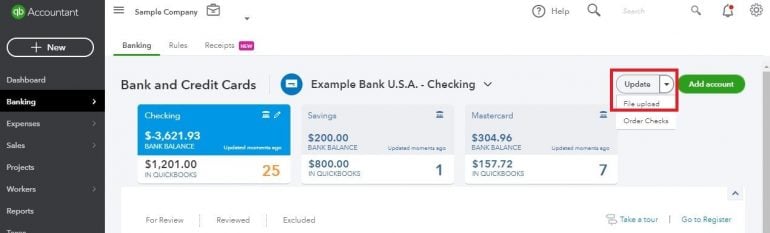

Start by clicking on the Update button. Give the connections a few minutes to refresh and encounter if new transactions are brought in automatically.

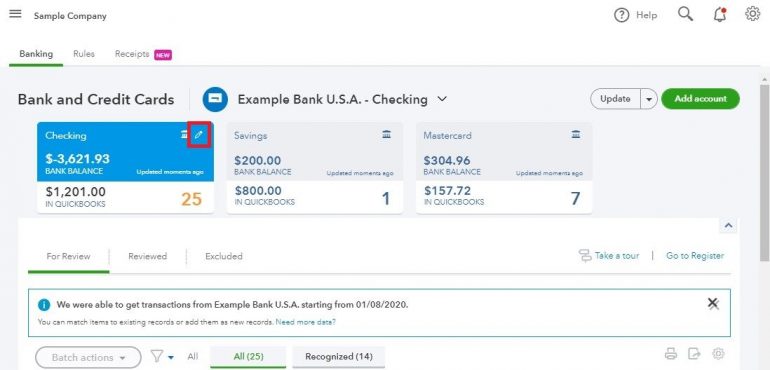

Sometimes, the banking company feed volition need to be reconnected. This typically happens when you change your login data with your financial institution. If this happens, click the pencil icon side by side to the account you need to reconnect.

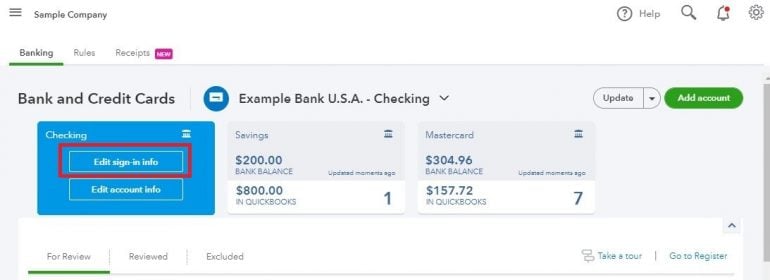

And then select "Edit sign-in info."

Rarely, y'all might have to disconnect the account from Cyberbanking altogether and and so reconnect it. Before you proceed with the next step, lucifer or accept whatever transactions currently waiting for y'all in the bank feed. Otherwise, they volition be deleted when you disconnect the account.

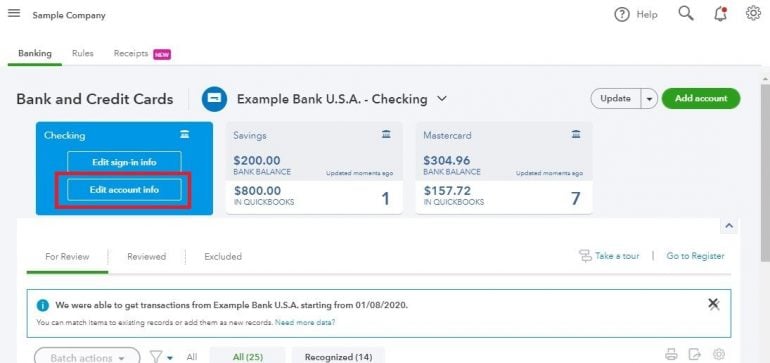

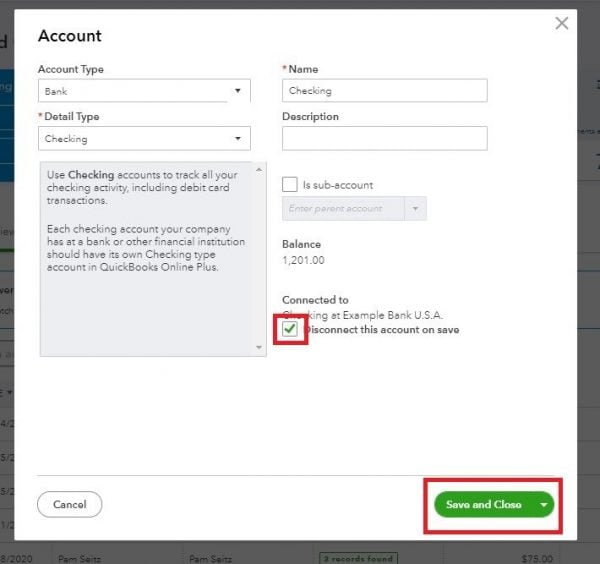

Click on "Edit business relationship info."

Then bank check the box next to "Disconnect this account on save" and click Save and Shut.

Now follow steps ane through seven in a higher place to reconnect the account.

Import transactions into QuickBooks from Excel

Sometimes, you might have to manually import bank transactions into QuickBooks Online. This can happen when the start date for your import is earlier than the engagement from which QuickBooks Online can pull transactions or — more than rarely — if your financial establishment does not interface with QuickBooks Online.

1. Log into your bank or credit card account straight and find the selection to download or export transactions. Y'all must consign transactions in CSV, QFX, QuickBooks Online or OFX format. If your depository financial institution doesn't consign to ane of these formats, wait for an selection to consign to Excel. Y'all can easily convert an Excel file to CSV format and utilize that for your import.

Every financial establishment is dissimilar, and sometimes information technology's not like shooting fish in a barrel to find the choice to consign your transactions. Yous might have to hunt around a bit – or contact your financial institution's customer service section – to detect the export choice.

Many banks limit how far back you can export transactions. If yous demand to consign transactions from further back than your banking concern allows, see if yous tin get PDFs of your statements from the months you lot still demand to import into QuickBooks Online. If yous can't export all the transactions you need from your bank but you tin get PDFs of the statements for those months, MoneyThumb has a product that will catechumen data from PDFs into a file you tin import into QuickBooks Online.

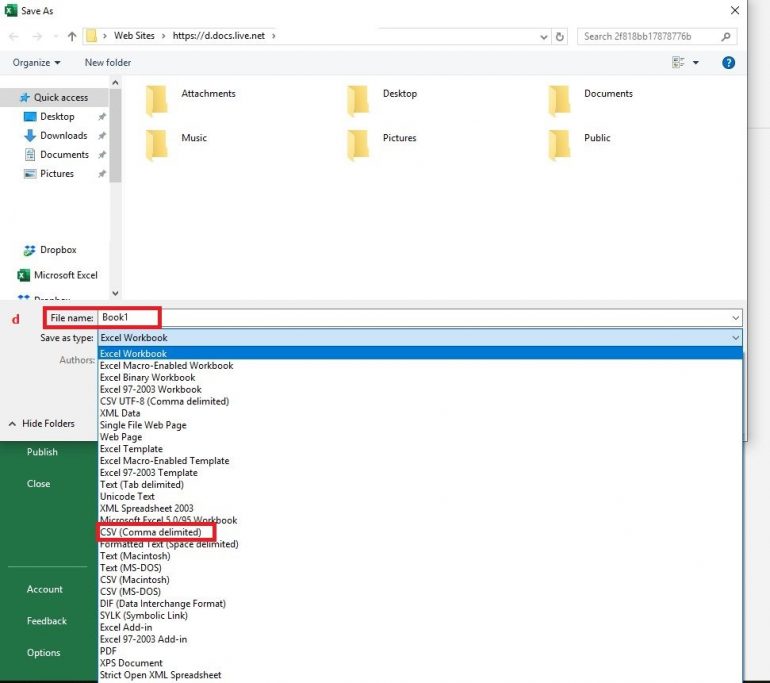

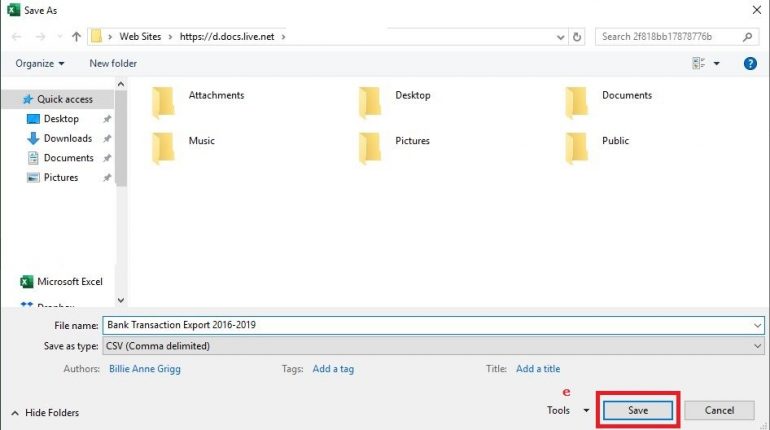

2. If you had to export your banking concern transactions into Excel instead of CSV, QFX, QuickBooks Online or OFX, you'll demand to save the file every bit a CSV file. To do that, open up the file y'all downloaded from your banking company, so:

-

Click on File.

-

Click on Save As.

-

Choose the location where y'all want to save the file. You can choose from the file listing that appears, or you can click on Browse.

-

Alter the File Name (if desired) then change "Salvage every bit type" to CSV (Comma delimited).

-

Click Relieve.

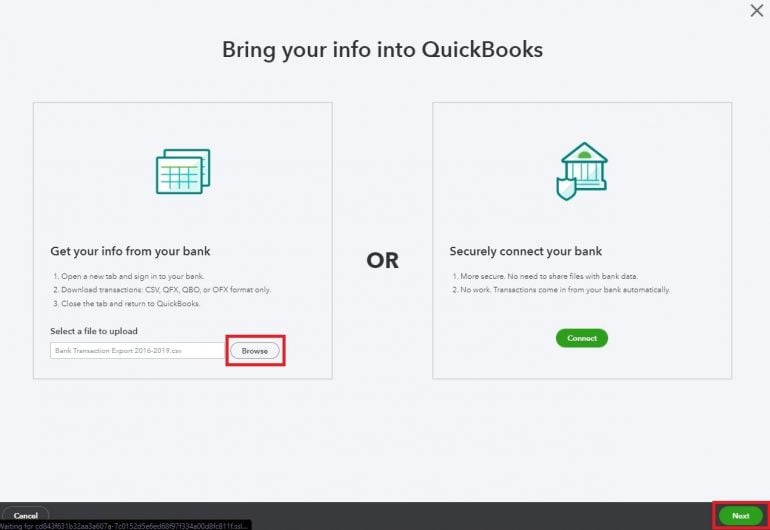

3. Now you're set to import your transactions into QuickBooks Online. Go to the Banking screen as in Step 1 to connect to your financial establishment, but this fourth dimension you'll click the downwardly arrow next to the Update button and choose "File upload."

4. Click on the Scan button, find the file yous desire to upload, then click Next.

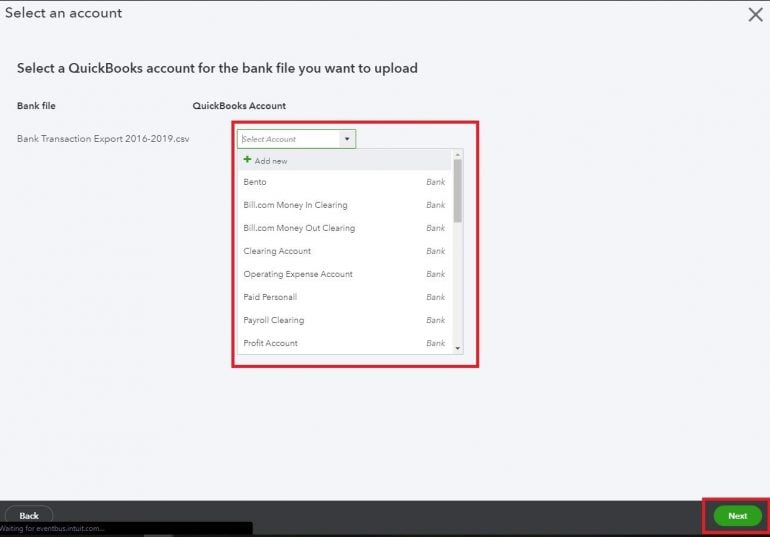

5. Choose the business relationship where you want to upload the transactions, then click Next. If the banking company or credit card account where you are uploading the transactions doesn't already be in your chart of accounts, y'all can add information technology by clicking "Add new" at the summit of the drib-down listing.

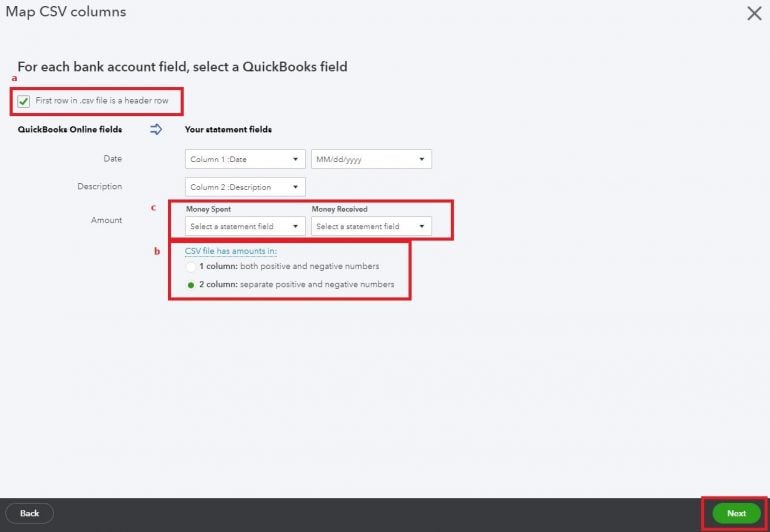

6. At present you'll demand to map the columns in your CSV to QuickBooks. Accept intendance here; incorrect mapping will import your transactions incorrectly.

You have an option to indicate that the beginning row in the CSV file is a header row (a). This volition commonly be the instance but double-check your CSV to make sure there isn't data that needs to be imported in Row ane. You will also need to indicate whether your credits and debits are in one column or two columns (b). If your debits and credits are in separate columns, you will demand to map those columns separately (c).

When yous are done mapping, click Side by side.

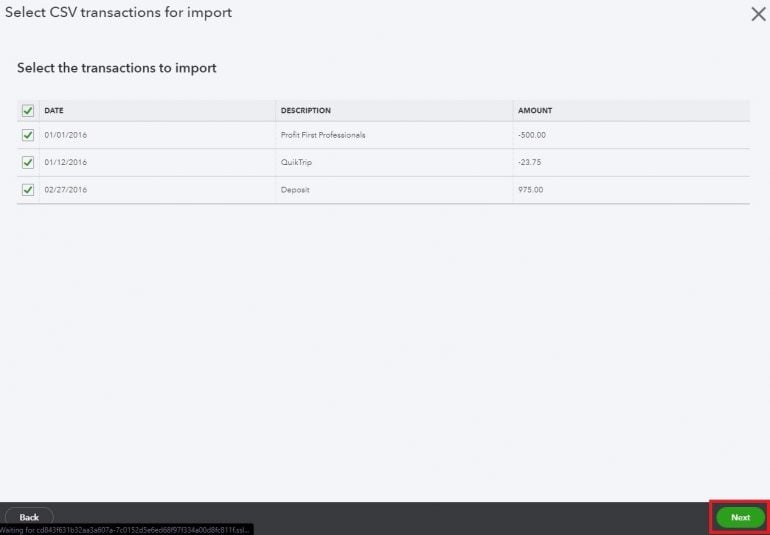

7. The next screen will give yous a preview of the transactions you are most to import. The QuickBooks Online default is to select all transactions, and this is what nosotros recommend unless you are certain there are duplicates in your CSV file. Brand sure the data looks correct by comparing the data on this screen to the CSV you are using for the import, and so click Adjacent.

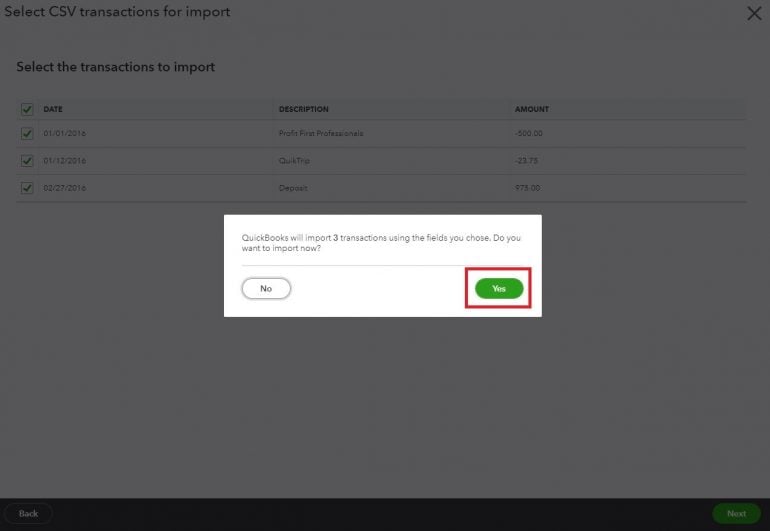

8. At present, y'all'll see a pop-up box that tells you how many transactions will be imported. Click Yeah if yous are set up to complete the import. If non, click No. If you lot click No, y'all volition have to outset the import process again from Step 3 when you're ready to keep.

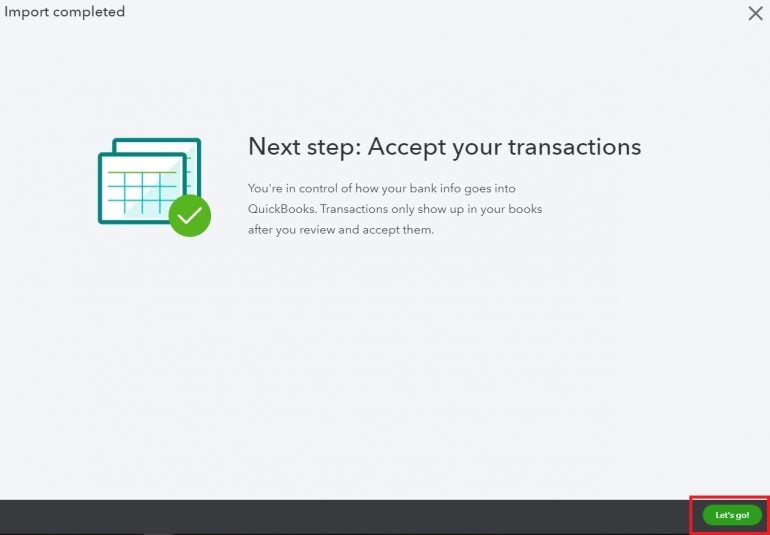

9. In one case the import is complete, you'll get a screen prompting you to accept your transactions. Click "Permit'south go!" to be taken to the Cyberbanking screen to start matching or adding your transactions.

Considerations when importing transactions into QuickBooks Online

Information technology'due south easy to import transactions into QuickBooks Online, only there are a few things you need to be aware of before you go on.

Overwriting existing banking transactions

If transactions exist in the Banking screen, you must accept those before importing new transactions using the manual (from Excel) import characteristic. Otherwise, the existing transactions will be overwritten in the import, and you will accept to do some other manual import to replace them so yous can accept or match them.

Indistinguishable transactions

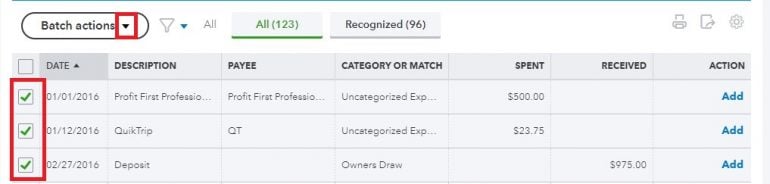

Whenever you lot import bank transactions into QuickBooks Online, there is a chance you lot could inadvertently indistinguishable some transactions. If you lot discover you have imported duplicate transactions, you can hands exclude the duplicates from your bank feed.

Select the duplicate transactions, then click the down arrow adjacent to the "Batch actions" button.

Now, click on "Exclude selected."

The selected transactions will be removed from your Cyberbanking screen. If you later detect they were non duplicate transactions, you tin can restore them by clicking on the Excluded tab, selecting the transactions you lot want to restore, and and so using the "Batch actions" push to Undo the exclusion.

Opening balance disinterestedness

When you import your transactions past connecting to your financial institution, QuickBooks Online volition bring in the balance on the business relationship as of the first date of your import by making an entry to an account called Opening Residuum Equity. If you don't take whatever data in QuickBooks Online for the bank or credit card prior to the import, and so this entry will have no impact on your reconciliations. In fact, it will assist brand your showtime reconciliation easier.

Still, if you have been manually entering or importing your transactions and then you subsequently connect to your fiscal establishment, the Opening Remainder Equity entry volition impact your next banking concern reconciliation.

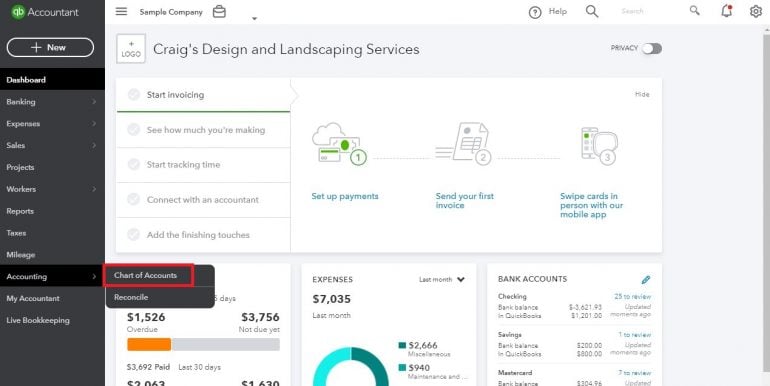

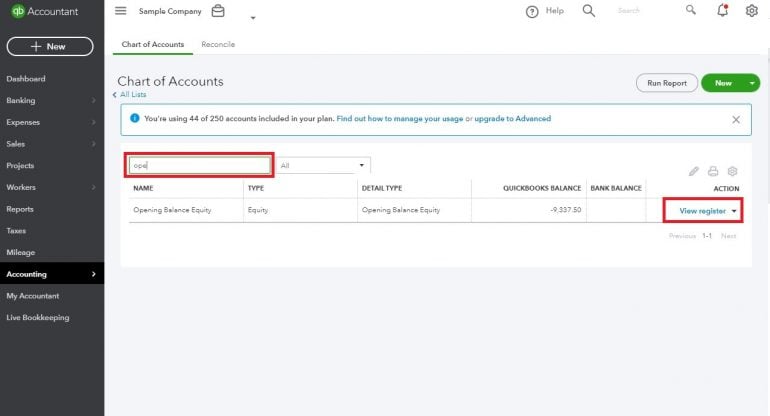

If you have difficulty with your first reconciliation after connecting to your financial institution, go to your nautical chart of accounts and search for the Opening Balance Equity business relationship. Click on "View register" to come across the transactions in the account.

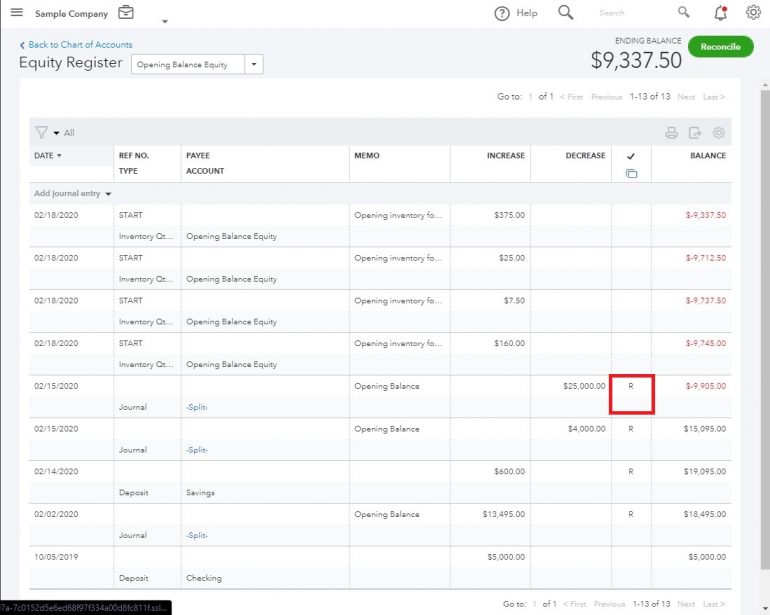

Find the opening residue entry for the account you are attempting to reconcile, so "unreconcile" that transaction by clicking on the "R" until that field is blank.

Now, return to your reconciliation and see if you lot are able to reconcile. If you can now reconcile the business relationship, you lot can delete the Opening Rest Equity entry for the account. If yous all the same have trouble reconciling, though, reach out to your bookkeeper or accountant for help.

QuickBooks Online resource

Read more than about how QuickBooks Online works.

A version of this commodity was commencement published on Fundera, a subsidiary of NerdWallet

How To Upload Bank Statement .qbo File Online Quickbooks,

Source: https://www.nerdwallet.com/article/small-business/how-to-import-bank-transactions-into-quickbooks-online

Posted by: padillayourejough.blogspot.com

0 Response to "How To Upload Bank Statement .qbo File Online Quickbooks"

Post a Comment